Would Warren Buffett Buy Adobe at a 16× Forward P/E?

Adobe, a dominant creative software powerhouse, has seen its valuation drop sharply in 2025. With a strong moat, consistent earnings, and a surprisingly modest valuation, this analysis explores whether Warren Buffett would consider buying ADBE today.

Would Warren Buffett Buy Adobe at a 16× Forward P/E?

Moat & Leadership — Exceptional (Score: 5/5)

Adobe has one of the strongest and most durable moats in technology — a near-monopoly in creative software with products like Photoshop, Illustrator, and Acrobat. Its switching costs are immense, as professionals and enterprises are deeply embedded in Adobe’s Creative Cloud ecosystem. The brand is synonymous with creativity worldwide. Under CEO Shantanu Narayen, Adobe successfully transitioned from boxed software to a recurring SaaS model. Its 52.9% ROE and 35% ROIC confirm exceptional capital efficiency.

Verdict: Classic Buffett-grade moat — durable, high switching costs, and a proven leadership team focused on long-term compounding.

Fundamentals — Excellent (Score: 4.5/5)

Adobe’s fundamentals remain among the best in the software sector. Revenue grew 14% annually over the past 5 years, and earnings per share rose 15.5% over that period. Even now, growth remains around 10% yearly — rare for a company of its size. Margins are superb (26% net profit margin), and the company’s debt-to-equity ratio of 0.53 reflects a strong balance sheet. Cash flow per share stands at $18, with a P/CF of 22× — indicating strong free cash generation.

Verdict: A financial fortress with predictable cash flows and disciplined capital allocation.

Earnings & Margins — Very Strong (Score: 4.5/5)

Earnings have risen steadily for more than a decade, supported by a robust subscription model that provides high visibility. With 52% ROE and 35% ROIC, Adobe ranks among the most efficient large-cap tech companies. Its profitability is resilient, even during downturns, thanks to recurring revenues and global creative demand.

Verdict: A textbook example of consistent profitability — a compounding engine Buffett would admire.

Valuation & Margin of Safety — Attractive (Score: 4.5/5)

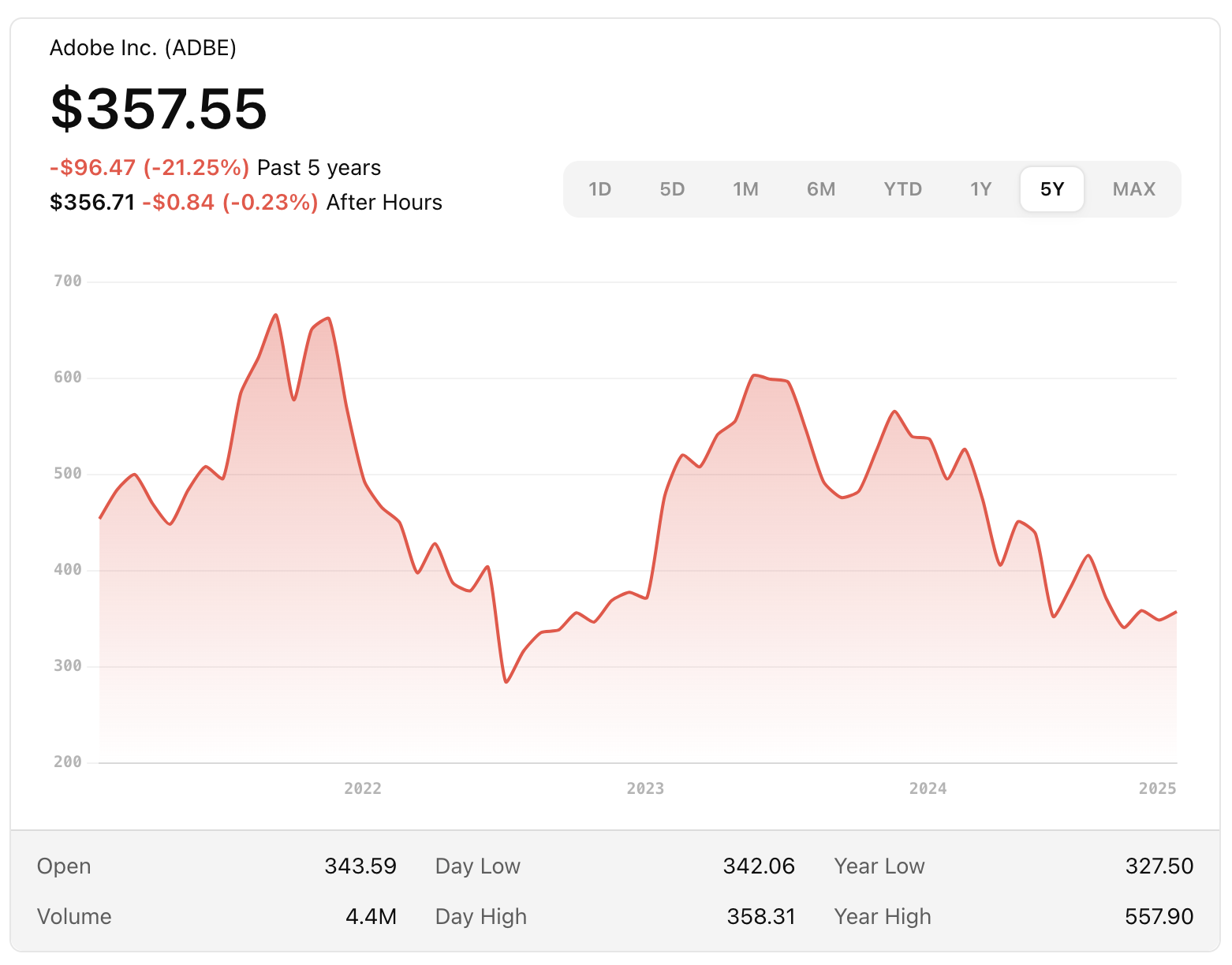

At $337.51, Adobe trades at just 21× trailing earnings and around 16× forward earnings — levels not seen in nearly a decade. The forward PEG ratio is ~1.2, suggesting fair-to-undervalued pricing for a wide-moat compounder. The stock is down 39% from its 52-week high and trades about 25% below intrinsic value based on a conservative DCF with 10–12% growth and a 9% discount rate.

Verdict: A rare chance to buy a dominant software business at a meaningful discount to its long-term worth.

Risks, Competition & Disruption — Manageable but Real (Score: 4.0/5)

Despite Adobe’s dominant position, it faces credible competition and emerging disruption from AI-driven creative platforms. Rivals like Canva, Figma, and Affinity challenge its design dominance, while DocuSign and Foxit compete in e-signatures and PDFs. In marketing automation and analytics, Salesforce, Oracle, and HubSpot remain strong alternatives. The bigger shift, however, is technological — with generative AI tools like Midjourney, Stability AI, and OpenAI’s DALL·E lowering the barrier for creative production.

The risk is real but not alarming. Adobe’s professional ecosystem, brand trust, and deep enterprise integration provide resilience. Its Firefly AI suite, embedded directly into Photoshop and Illustrator, shows the company is innovating rather than reacting. While smaller, nimble competitors will continue nibbling at the edges, Adobe’s scale, switching costs, and product depth give it the strength to adapt. In Buffett’s terms, the moat is being tested — but it’s still wide and actively reinforced.

Buffett’s Lens — Would He Buy?

Adobe fits nearly every Buffett filter — wide moat, stable earnings, high return on capital, and strong management. While Buffett traditionally avoided pure tech, his Apple and Amazon stakes show he values predictable tech cash flows. Adobe aligns with that philosophy.

| Buffett Criteria | Adobe’s Status |

|---|---|

| Durable Moat | ✅ Strong (5/5) |

| Consistent Earnings Power | ✅ Yes |

| High ROE / ROIC | ✅ Yes |

| Modest Debt | ✅ Yes |

| Capable, Long-Term Management | ✅ Excellent |

| Attractive Valuation | ✅ Yes (Unusually Cheap) |

Conclusion — Buffett Would Likely Be Interested (Overall Score: 18.5/20)

Adobe’s rare combination of moat strength, consistent fundamentals, and discounted valuation makes it a quintessential Buffett-style stock. Though he may prefer simpler consumer franchises, the evolved Berkshire strategy under Buffett and Combs/Weschler increasingly embraces tech-enabled compounders with stable cash flows. In a market where many stocks trade at stretched valuations and investor enthusiasm has pushed multiples to extremes, Adobe stands out as a hidden gem — a dominant, cash-generating franchise temporarily overlooked by sentiment.

- Moat & Leadership — 5.0 / 5.0

- Fundamentals — 4.5 / 5.0

- Earnings & Margins — 4.5 / 5.0

- Valuation & Margin of Safety — 4.5 / 5.0

- Total — 18.5 / 20 (Buffett-grade quality at a reasonable price)

In Buffett’s language, Adobe today looks like a ‘wonderful business at a fair price.’ While much of the market remains expensive and driven by hype, Adobe offers genuine value backed by real earnings power — a rare large-cap opportunity where fundamentals and valuation truly align. It’s unlikely to stay this cheap for long once market sentiment normalizes.

More details about ADBE's moat, fundamentals, financials, and valuation:

ADBE Stock Analysis

Leave a Comment