Adobe: A High-Quality Compounder at a Buffett-Friendly Price?

Adobe is a dominant force in digital design, but does it align with Warren Buffett’s value investing principles? Let’s break down its competitive advantage, earnings, growth, and valuation to see if it qualifies as a Buffett-style investment.

Adobe’s industry dominance and financial strength make it a compelling investment.

1. Does Adobe Have a Durable Competitive Advantage?

Warren Buffett often says, “The most important thing to do if you find yourself in a hole is to stop digging.” But when it comes to investing, he prefers to find businesses with a deep moat—one that competitors struggle to cross.

Adobe has one of the widest moats in the tech industry.

- Creative Cloud Dominance: Adobe's Photoshop, Illustrator, and Premiere Pro are industry standards in design, photography, and video editing.

- Subscription Model: Nearly 100% of its revenue is recurring, creating stability.

- Document Cloud Leadership: Adobe Acrobat and PDF solutions are indispensable for enterprises.

- AI & Automation: Firefly AI and Sensei AI tools are positioning Adobe for the next decade of creative software.

✅ Verdict: Strong Moat—Adobe holds an unshakable position in digital content and design software.

2. Earnings & Cash Flow Stability

Buffett likes predictable, consistent earnings growth. He invests in businesses that print cash year after year.

| Metric | Adobe (2025E) | Buffett’s Benchmark |

|---|---|---|

| Gross Margin | 89% | Above 50% is ideal |

| Operating Margin | 36% | Above 20% preferred |

| Return on Equity (ROE) | 36.3% | Above 15% is excellent |

| Return on Invested Capital (ROIC) | 27% | Above 15% preferred |

| Long-term Debt/Capital | 0.29 | Below 0.50 is safe |

| Free Cash Flow Margin | ~40% | High FCF preferred |

✅ Verdict: Exceptional Profitability & Cash Flow—Adobe checks all the boxes for a Buffett-style business.

3. Growth and Future Earnings Potential

Buffett doesn’t chase high growth but prefers companies with steady, long-term growth rates.

- Revenue Growth: 10.8% (2024E), 9.4% (2025E), 9.9% (2026E)

- EPS Growth: $11.83 (2023) → $12.36 (2024E) → $20.40 (2025E)

- 5-Year Growth Forecast: ~13% CAGR

✅ Verdict: Consistent Growth—Adobe isn’t a hyper-growth stock, but it’s a steady compounder.

4. Valuation: Is Adobe Cheap Enough for Buffett?

Buffett doesn’t buy great companies at any price—he waits for a fair or undervalued price.

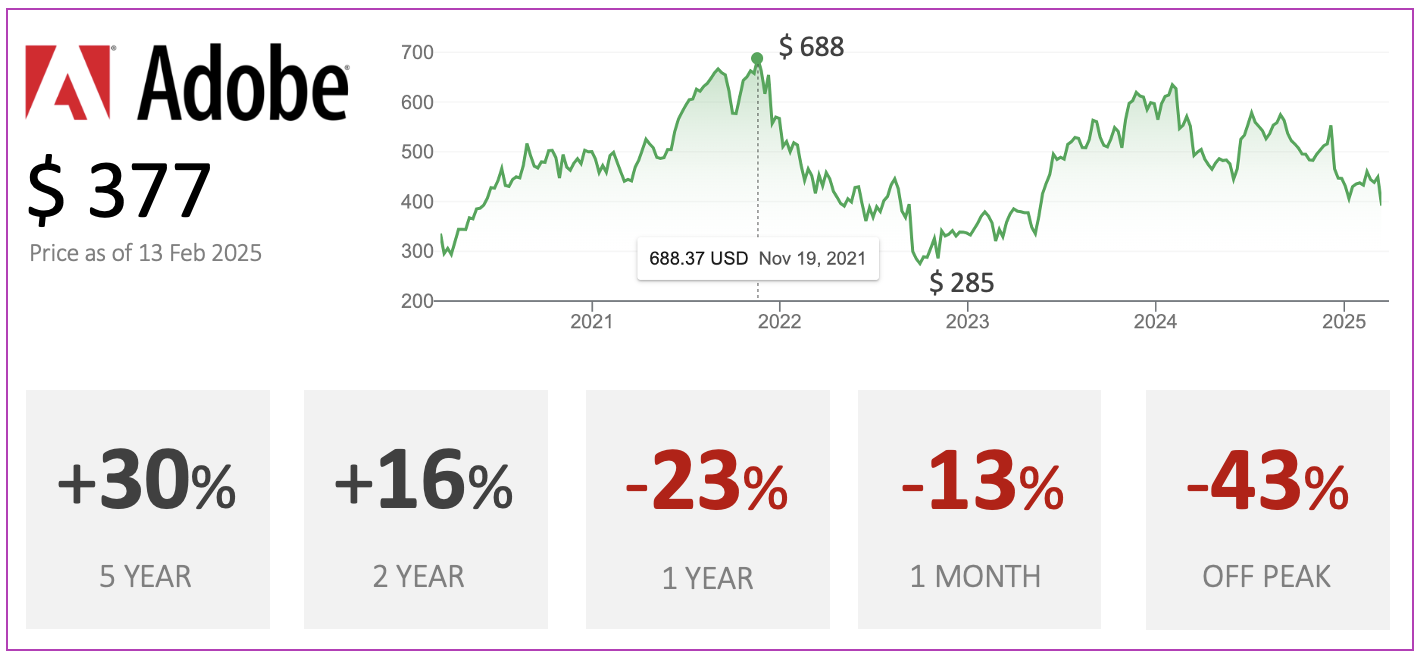

- Current Price: $378

- 2025E EPS: $20.40 → Forward P/E = 18.5

- 2026E EPS: $23.05 → Forward P/E = 16.4

✅ Verdict: Attractive Valuation—Adobe is trading at its lowest forward P/E in years.

5. Is Adobe a Buy Now?

Buffett says, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

At $378 and a P/E of 18, Adobe now looks like a Buffett-style buy.

Potential Buy Zones:

- 📌 $360-$375 → Great Buy

- 📌 $340-$360 → Strong Buy

- 📌 Below $340 → Back up the truck!

Leave a Comment