NVIDIA's Value Proposition Through a Value Investor’s Lens

For a value investor like Warren Buffett, a stock must meet key criteria: a strong economic moat, high profitability, financial discipline, and reasonable valuation. NVIDIA (NVDA) is a powerhouse in AI and semiconductor technology, but does it align with Buffett-style investing principles?

NVIDIA's AI dominance and strong financials make it an intriguing investment.

1. Economic Moat: Industry Leadership in AI Chips

NVIDIA dominates the AI, GPU, and data center markets, giving it a near-monopoly on AI processing hardware. Its CUDA software ecosystem creates high switching costs, reinforcing its competitive edge. While competitors like AMD, Google (TPUs), and custom AI chips from cloud providers pose risks, NVIDIA's deep integration into AI workflows gives it a significant moat.

2. Financial Strength and Profitability

NVIDIA has:

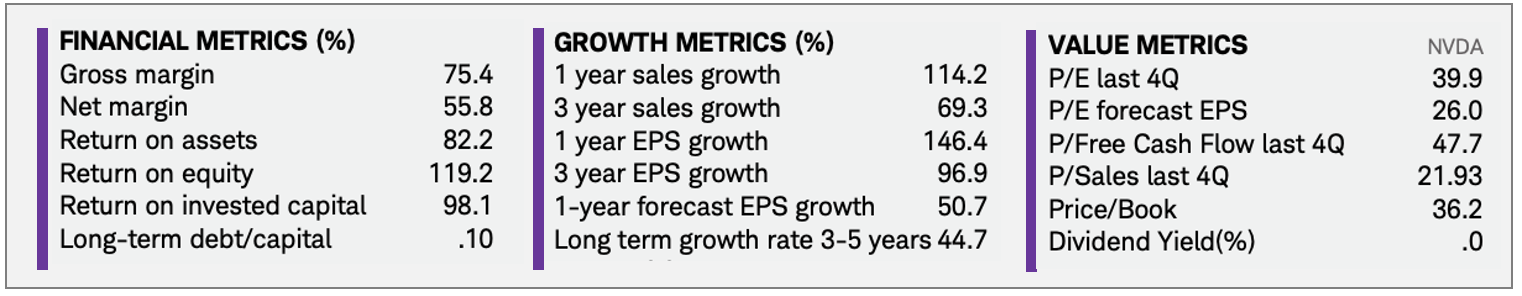

- ✔ Gross Margins of 75.4%, well above industry norms.

- ✔ Net Margins of 55.8%, indicating exceptional profitability.

- ✔ Return on Equity (ROE) of 119.2%—Buffett loves companies that generate high returns on capital.

- ✔ Minimal Debt (Long-term debt/capital = 0.10), making it financially sound even in downturns.

Buffett prefers cash-rich businesses that don’t rely heavily on debt, and NVIDIA’s strong balance sheet and cash flow generation fit the bill.

3. Growth Potential and AI Tailwinds

While hyper-growth is typically not a Buffett focus, NVIDIA’s AI-driven expansion into data centers, automotive, and cloud computing suggests long-term compounding potential. However, as Buffett advises, growth projections should be discounted to account for risks such as competition, supply chain constraints, and cyclical demand.

4. Valuation: A Critical Factor

Buffett’s biggest hurdle for NVIDIA is valuation:

- ✔ Forward P/E of ~25x is reasonable compared to historical levels but still higher than Buffett’s preferred deep-value picks.

- ✔ The stock is down 25% from its peak, presenting a rare opportunity to buy a great business at a fair price.

Final Verdict: A Great Business, But Not a Deep Value Stock

✔ Does NVIDIA have a strong moat? ✅ Yes.

✔ Is it highly profitable with strong returns on capital? ✅ Yes.

✔ Is it available at a “Buffett bargain” price? ❌ Not yet, but better than before.

For value investors, NVIDIA is a high-quality company, but not a classic Buffett-style deep value play. However, given its dominance in AI, high profitability, and recent stock pullback, building a small position could be justified for long-term investors—with an eye on valuation and downside risks.

Leave a Comment