When the Market Panics, Opportunity Knocks: A Buffett-Style Perspective

A sharp market drop can rattle nerves, but it’s often the best time to invest. Warren Buffett reminds us that fear creates opportunity. In this post, we highlight how recent price drops in quality stocks like GOOGL, AMZN, ADBE, NKE, and JPM may be opening the door to long-term gains for patient investors.

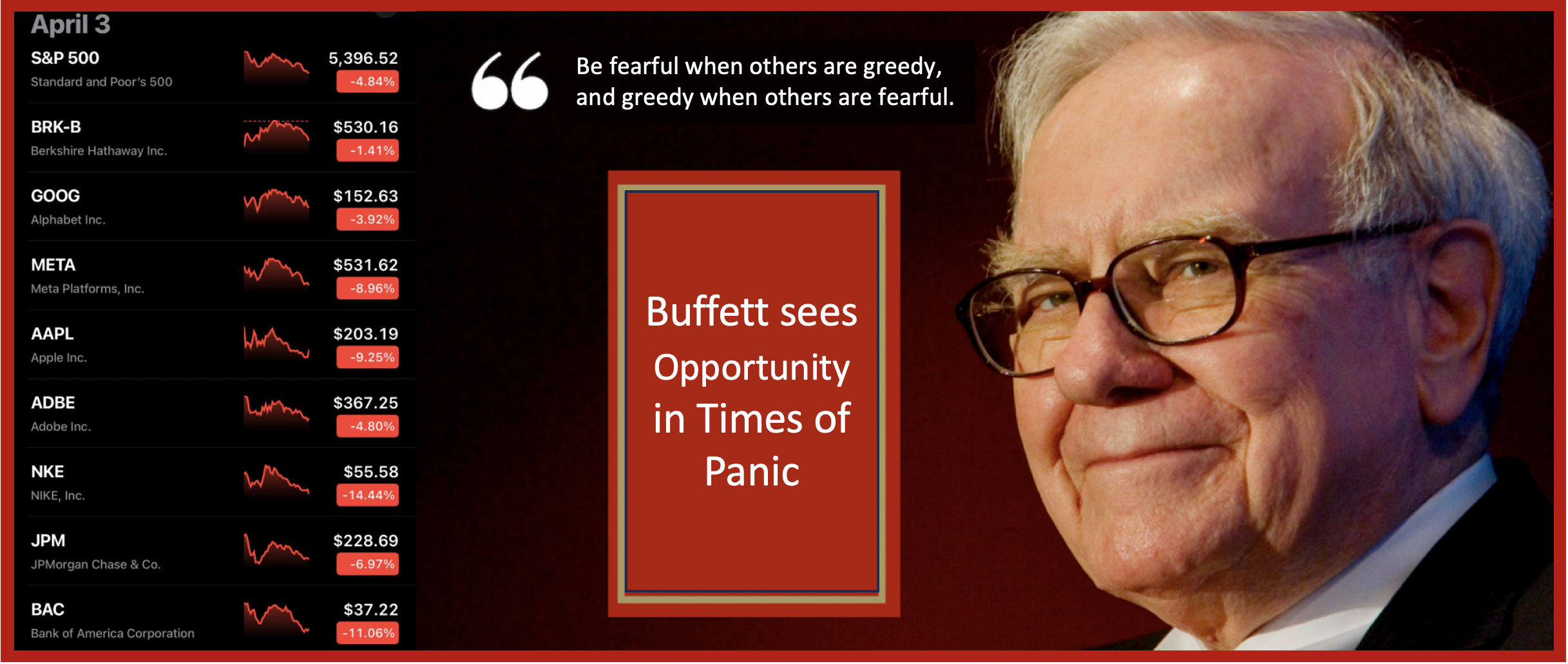

In times of panic, Buffett sees opportunity—not chaos.

Mr. Market Had a Panic Attack

S&P 500 dropper nearly 5% while the Dow Jones dropped nearly 1,700 points. The Nasdaq fell almost 6%. Even rock-solid names like Google, Amazon, Adobe, and Nike took a beating. But Warren Buffett teaches us that price isn’t the business—it’s just what people are willing to pay today. When prices fall but businesses remain strong, opportunity arises.

- GOOGL – Still dominates digital advertising and AI, now priced 4% lower.

- AMZN – E-commerce and cloud giant temporarily marked down.

- ADBE – Creative software monopoly going for 5% off.

- NKE – Global brand on sale after a 13% drop.

- JPM & BAC – Financial powerhouses now yielding higher value.

- OXY – A Buffett-backed energy bet now down 10%.

These companies didn’t become bad businesses overnight—they just became cheaper. And that’s the essence of value investing.

“The stock market is a device for transferring money from the impatient to the patient.”

Buffett’s Timeless Lens

Buffett doesn’t buy the market—he buys businesses. And when good businesses go on sale, he doesn’t flinch. He gets curious. He dives deeper into the fundamentals and asks:

- Does the company still have a moat?

- Has its long-term earning power changed?

- Is the stock now offering a margin of safety?

If the answers point to durability and value, Buffett doesn’t panic—he invests. That’s the lens we apply today.

Volatility: The Value Investor’s Friend

To the average investor, volatility feels like risk. To Buffett, it’s the opportunity to buy a dollar for 70 cents. When others are selling out of fear, value investors lean in with conviction.

- Volatility offers better entry points for long-term investors.

- Fear-driven selloffs often lead to mispricing of high-quality companies.

- Disciplined investors with cash can benefit from these market overreactions.

Markets correct, rebound, and grow—but those who capitalize on fear build lasting wealth.

“Be fearful when others are greedy, and greedy when others are fearful.”

Final Thoughts: The Golden Buckets

Buffett once said, 'Opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.' That’s what today looks like: a gold rainstorm for the patient, business-minded investor.

If you’ve been waiting for a window to buy quality stocks with a long-term edge—this might just be it. Don’t follow the panic. Follow the fundamentals.

“Opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.”

Leave a Comment