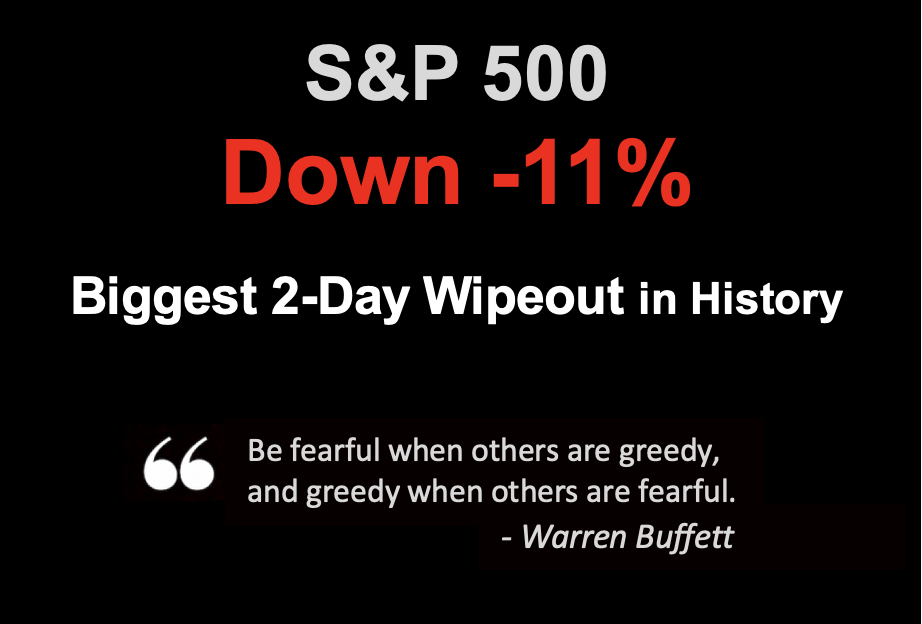

Buffett’s Take on Market Carnage: Why Smart Investors See Opportunity

📉 A sharp market drop can rattle nerves, but it’s often the best time to invest. Warren Buffett reminds us that fear creates opportunity. In this post, we highlight how recent price drops in quality stocks like GOOGL, AMZN, ADBE, NKE, and JPM may be opening the door to long-term gains for patient investors.

Read More →

Adobe: A High-Quality Compounder at a Buffett-Friendly Price?

📉 With Adobe’s stock down 13%, its valuation has reached Buffett-style territory. Is this a rare chance to buy a high-quality compounder at a fair price, or is Wall Street right to be skeptical?

Read More →

NVIDIA's Value Proposition Through a Value Investor’s Lens

NVIDIA (NVDA) is a powerhouse in AI and semiconductor technology, but does it align with Buffett-style investing principles?

Read More →

You Don’t Have to Swing at Every Pitch: Lessons from Buffett and High-Flying Stocks

Warren Buffett’s investing wisdom teaches us patience. Unlike baseball, there’s no penalty for waiting..

Read More →

Buffett-Style Value Investing Meets AI: A Smarter Way to Identify True Value

AI can make stock investing the Buffett-value-style

Read More →